Crypto Intelligence: How AI Agenting Powers the Blockchain

Introduction

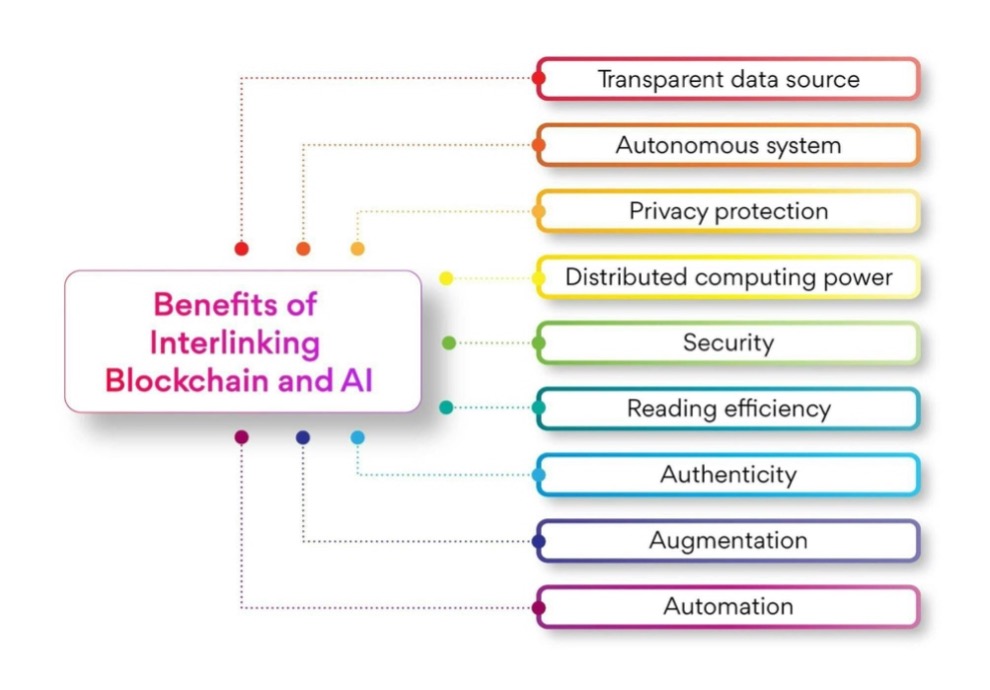

AI is now everywhere, transforming industries, by helping in automation at various levels, intelligence, and efficiency. From arts to healthcare to finance, AI has reshaped traditional methodologies with innovative and intelligent ones. In the world of blockchain and cryptocurrency it’s going to be game changer. With the transparency, security and decentralization in blockchain, AI is now helping in optimizing trading strategies, fraud detection, and automation of complex tasks. Let’s deep dive into the buzzing AI Agents, and how they advance the world of crypto intelligently!

What are AI agents and how do they integrate with crypto?

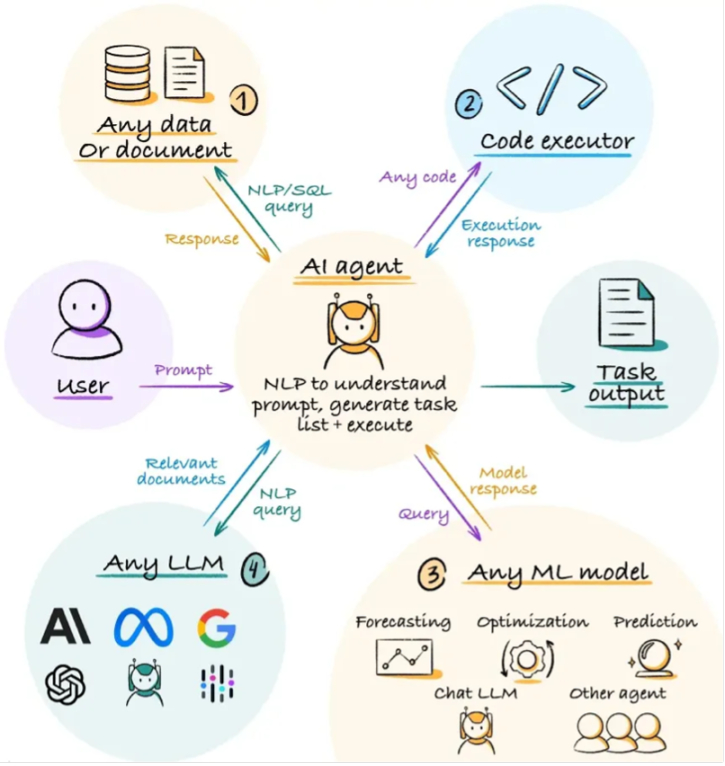

In recent years, the integration of AI and crypto has led to interesting innovations, particularly “AI Agents.” AI agents in the Crypto world are autonomous software or programs. AI Agents combine large language models (LLMs) with the ability to make independent decisions based on environmental analysis. They focus on planning, memory, and tool utilization, enabling them to make decisions and execute actions like humans, without constant human oversight.

Think of them as automated software capable of dynamic decision-making, operating independently, interacting with other systems, and handling complex tasks effectively, unlike typical AI bots. These utilize artificial intelligence (AI) to interact with blockchain protocols, enabling functionalities like trading, token swapping, portfolio management, even engaging with decentralized finance (DeFi) platforms. This automation thus helps in complex processes and tasks, these agents help users to finance strategies, reduce manual errors, and execute transaction more efficiently.

The integration of AI agents in crypto helps in the broader trend of combining the AI and Blockchain technology together. These AI agents improve the capabilities of smart contracts and decentralized applications (DApps). They can do so by performing analysis on large volumes of market data, identifying trends, and hence making informed decisions on their own.

The crypto AI agents are generally in the form of chatbots, these advanced virtual assistants are designed to simply the complexities involve in cryptographic onchain transactions. With the help of natural language understanding (NLU), conversation generative AI, crypto agents can provide the real-time guidance, track and analyze market trends, and facilitate secure transactions. They assist the user in informed decision, give insights.

Automating Crypto with AI agents have following advantages:

-

Automating Tasks: Simplify transactions by automating trading, managing portfolio etc.

-

Smart Decision-Making: Traditional chatbots work on defined rules, AI agents are capable to adapt and make intelligent decisions.

AI Agents (Source)

How AI Agents Drive Automation in Crypto

AI agents automate the crytpo task in following ways:

-

Automated Financial Management and Assistance: Act as personal financial advisers, autonomously manage trades and portfolios, recommend, managing payments and bookings.

-

Efficient Transaction Processing: Handling large fast-paced transactions and keep up with fast changing trading trends.

-

Natural Language Interaction: Users can perform operation through simple natural language texts or voice commands.

-

Enhanced Security: Advanced technologies like multi-party computation (MPC) ensure robust security, safeguarding assets from unauthorized access.

How Are Crypto AI Agents Different from Bots?

While AI agents and bots both can help in task automation, responding to queries, and assisting with routine tasks, yet differ in the underlying mechanism.

-

Bots: are deterministic, they work on rule-based system. They perform on predefined scripts written by developers, execute instructed tasks with no context. They have less adaptability, best suited for repetitive, less complex tasks, like arbitrage or market-making.

For example, a trading bot might place a buy order when a token's price drops below a set threshold, regardless of whether the action is strategically appropriate. -

Crypto AI agents: are probabilistic, leveraging machine learning and AI models to analyze data, predict outcomes, and make decisions. They adapt to patterns, trends, and probabilities, enabling more nuanced and intelligent actions. This flexibility allows them to handle dynamic, high-complexity tasks such as sentiment analysis or fraud detection.

Types of AI Agents and their Use-case in Crypto

AI agents operate as virtual employees which undertake distinguished assignments across the crypto industry. AI agents execute their functions through two different methods: immediate response such as price trend monitoring as well as strategic planning that optimizes investment strategies and facilitates cooperation toward collective objectives. AI agents operate under various categories that serve specific use cases in crypto as follows:

-

Reactive Agents: Respond in real-time without memory or internal models. Example: Real-time NFT generation based on live events.

-

Goal-Oriented Agents: Focus on achieving specific objectives or targets. Example: Optimizing yield farming and staking in DeFi protocols.

-

Learning Agents: Adapt through the process of data analytics and experience accumulation to improve themselves. Example: AI agents can identify the best upcoming projects suitable for venture investment.

-

Utility-Based Agents: Maximize specific outcomes, such as profits or risk reduction. Example: Financial portfolio management and rebalancing strategies.

-

Collaborative Agents: Work with other agents or humans to achieve shared goals. Example: Enhancing DAO governance through optimized voting and proposals.

-

Model-Based Reflex Agents: Use internal models to handle partial information for better decisions. Example: On-chain fraud detection and scam prevention systems.

-

Belief-Desire-Intention Agents: Balance user beliefs, goals, and intentions to guide actions. Example: Virtual wallet assistants providing transaction guidance.

-

Interface Agents: Offer personalized support and learn user preferences. Example: AI KOLs (Key Opinion Leaders) delivering tailored social media insights.

-

Mobile Agents: Operate across networks to perform tasks remotely. Example: Managing distributed ledger systems and network optimization.

-

Multi-Agent Systems: Networks of agents working together to solve complex problems. Example: Blockchain analytics tracking market trends and whale movements.

Each type of AI agent plays a unique role in streamlining processes, improving decision-making, and enhancing user experiences in the crypto world.

How Crypto AI Agents Work

Crypto AI agents are sophisticated systems that combine natural language processing (NLP), machine learning (ML). Here's a streamlined overview of their workflow and architecture:

Workflow of Crypto AI Agents

-

Information Gathering: AI agents collect data from multiple sources, including token prices, blockchain transactions, news, and social media sentiment, using APIs, blockchain nodes, and oracles like Chainlink.

-

Learning and Analysis: The data is processed through AI/ML models (e.g., LSTM networks, Random Forests) to identify patterns, predict trends, and generate actionable insights.

-

Decision-Making: Based on the analysis, the agent determines the optimal course of action, such as executing a trade or rebalancing a portfolio.

-

Action Execution: The agent interacts with the blockchain to carry out decisions, such as placing trades, managing liquidity pools, or setting alerts.

-

Learning and Adapting: Over time, the agent refines its performance by learning from user interactions, market changes, and historical data.

Core Architecture of Crypto AI Agents

-

Data Input Layer:

Collects real-time and historical blockchain data via APIs (e.g., Web3.js, ethers.js) and blockchain nodes. Integrates off-chain data (e.g., market trends, social sentiment) through oracles like Chainlink. -

AI/ML Layer:

Utilizes models like LSTM networks, Random Forests, or reinforcement learning for financial predictions and decision-making.

Models are trained on historical data using techniques like backpropagation or Q-learning to improve accuracy and adaptability.

Enables the AI agent to take actions on behalf of the user, such as executing trades, interacting with smart contracts, or managing portfolios directly on the blockchain.

Key Risks of Using AI Agents

While AI agents bring efficiency to crypto trading, they also come with significant risks that investors must approach with caution:

-

Algorithmic Bias: AI agents may favor specific narratives or projects, creating misleading echo chambers that inflate token values without real fundamentals, leading to unsustainable price spikes.

-

Market Manipulation: AI tools can be exploited for pump-and-dump schemes, distorting market values through automated trading.

-

Speculative Hype: Examples like Truth Terminal, which promotes meme coins like Goatseus Maximus (GOAT), show how AI-driven buzz can drive prices up without fundamental support, making investments highly speculative.

-

Regulatory Gaps: The lack of oversight for AI-driven promotions allows bad actors to exploit these tools without accountability.

-

Security Vulnerabilities: If compromised, AI agents could manipulate trading strategies or market perceptions, causing significant harm.

Conclusion on the Future of AI Agents in Crypto

The integration of AI and crypto through AI Agents is a noteworthy trend, creating new applications and opportunities. It has the potential to revolutionize finance and technology within the crypto industry. However, AI adoption should be approached with caution, considering risks and implementing appropriate regulations to maximize benefits. Though this trend is in its early stages, rapid growth is expected soon.

References